The Independent Media and Policy Initiative have expressed optimism that the new policies introduced by the Central Bank of Nigeria (CBN) will contribute to stabilizing the naira in the foreign exchange market.

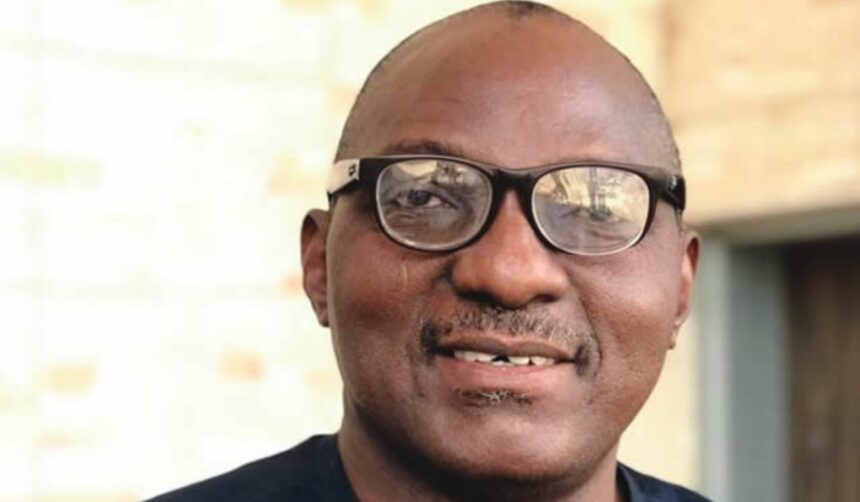

Niyi Akinsiju, Chairman of the non-governmental organization, issued a statement in Abuja commending the CBN’s efforts to address issues related to forex market volatility and enhance transparency in the banking sector.

Akinsiju stated that the recent policies reflect the new CBN management’s commitment to curb banking system excesses, particularly concerning the foreign exchange market.

He highlighted the gaming of the forex market by Deposit Money Banks (DMBs), where they hoard forex, limit customer access, and profit from forex holdings while bidding the naira to depreciate.

The chairman applauded the CBN’s directive for DMBs to sell off foreign currencies immediately held long-term to zero levels.

According to him, banks keep between six and seven billion dollars in long positions, either cash or forex swaps deals, showcasing the CBN’s regulatory oversight capacity.

Akinsiju emphasized that the new policy would incentivize International Money Transfer Operators (IMTOs) to redirect forex to the official market, discouraging diversion to the black market.

”This shift is expected to channel more diaspora funds into the Nigerian forex market, enhancing liquidity and potentially appreciating the naira,” he stated.

The CBN has been implementing various policies to address the decline of the naira in the foreign exchange market.

One notable measure is the circular mandating DMBs to ensure they do not exceed 20 per cent short, aligning their foreign currency assets with liabilities.

Banks exceeding these limits were directed to adjust to comply with the new regulations by February 1.