The Nigerian Oilfield Chemicals market is anticipated to experience notable growth, rebounding from challenges posed by the COVID-19 pandemic and economic uncertainties.

The sector demonstrated moderate growth in the pre-pandemic years, with increased oil and gas industry revenue attributed to a rise in crude oil output.

In 2019, Nigeria witnessed a 4.87% increase in total crude oil output, reaching 735.244 million barrels, compared to 701.101 million in 2018.

However, the onset of the COVID-19 pandemic in 2020 disrupted the oilfield chemical market due to lockdown measures that impacted supply chains, manufacturing processes, and overall developmental activities.

Throughout 2021, the market faced sluggish growth, influenced by economic crises, rising inflation, and incidents of oil theft.

The subsequent year, 2022, saw a resurgence as developmental activities resumed, complemented by the Nigerian government’s budget for 2022, which allocated a 25% increase, premised on crude oil production levels, to accelerate developments in the oil and gas sector.

The Nigerian Oilfield Chemicals Market is expected to maintain an upward trajectory, projecting a Compound Annual Growth Rate (CAGR) of 5.3% from 2023 to 2029.

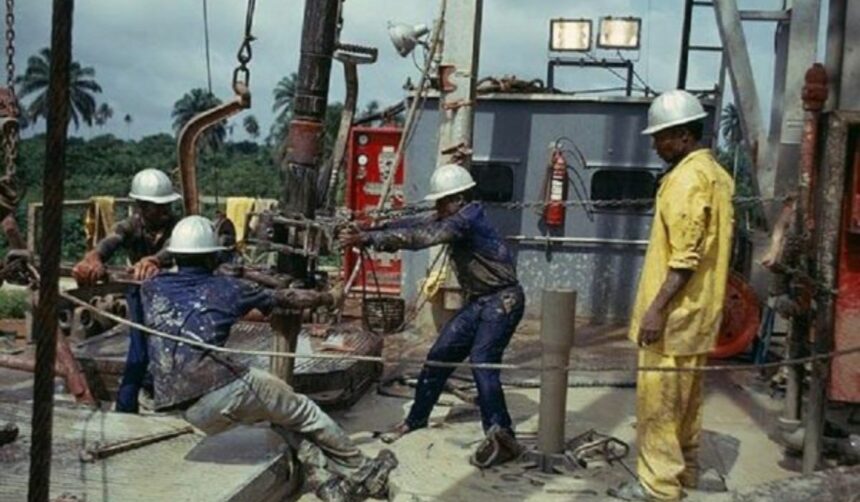

The growth can be attributed to increased crude oil production and ongoing developments in new oilfields.

Notably, Nigeria’s deepwater projects planned for 2023-2025 are poised to add approximately 2.3 billion barrels to the nation’s oil reserves.

The production segment dominated the market revenue in 2022, driven by the advantages of improving production maintenance and recovery from reserves.

As Nigeria aims to reach a crude oil production of 2.1 million barrels per day by December 2024, the demand for production chemicals is expected to surge, followed by drilling chemicals.

Demulsifiers took the lead in revenue share in 2022 among chemical types, followed by inhibitors and scavengers.

The increased use of these chemicals is vital for managing and treating massive amounts of fluids generated during healthy production, ensuring production efficiency and regulatory compliance.

The rising demand for petroleum-based fuels and substantial investments, with international oil firms committing $13.5 billion to raise oil production, are poised to drive demand for oilfield chemicals in the forecast period.